Wen Yan ke

After a period of time, did investors find it timely for Wang Xing to reduce his holdings of LI shares in mid-September?

01

On September 25th, LI (LI.O/2015.HK) 500,000 production car Ideal L7 rolled off the assembly line in Changzhou Intelligent Manufacturing Base, which is the flagship SUV of five families under the brand. Under normal circumstances, car companies will announce last month’s sales at the beginning of each month, ideally giving good news to shareholders in advance.

Since the first Li ONE rolled off the assembly line in November, 2019, 500,000 production cars have been rolled off the assembly line in 47 months, making it the first new car company in China to achieve this achievement. In addition, it takes only 100 days from the 400,000 th production car to the 500,000 th production car, showing an accelerated running trend.

The new force car companies are mainly Weilai (NIO.N/9866.HK), Tucki (XPEV.N/9868.HK) and Ideality. The founders were all entrepreneurial stars of the Internet technology track, then moved to the electric car track, and successively landed in US stocks and listed in Hong Kong stocks.

According to the data of professional automobile network, in 2022, the ideal sales volume will be 133,000, and the sales volume of Weilai and Tucki will be 122,000 and 121,000. Although they are ahead of the two old rivals, their advantages are not obvious.

In 2023, Ideality began to run at an accelerated pace. In the first eight months, the sales volume exceeded 240,000 vehicles, up by 171% year-on-year. In the same period, Weilai and Tucki sold 94,000 vehicles and 66,000 vehicles, which exceeded the sum of the two major friends, and their sales volume was more than 1.5 times, so they were no longer in a sales camp.

02

The large increase in sales also led to the ideal performance improvement and the stock price surge, forming a "Davis double click".

Ideal takes the lead in making profits among the new forces of car-making. In 2022, it still lost 2 billion yuan, but it made a profit of 170 million yuan in the fourth quarter, and then in the first half of 2023, it quickly increased its profit scale to more than 3.2 billion yuan.

At the same time, Weilai still lost 10.9 billion yuan in the first half of the year, and Tucki also lost 5.1 billion yuan. Naturally, they can’t turn losses into profits in 2023, and the profit time may be postponed until after 2025.

Ideal share price rose sharply this year, and the US stock market closed on Monday, with a cumulative increase of 73%, surpassing Tucki (68%) and Weilai (down 14%).

Compared with the latest market value, Weilai’s market value is $14 billion, Tucki’s is $14.5 billion, and the ideal market value is $37.5 billion, which is about 1.32 times of the total market value of Weilai and Tucki ($28.5 billion), which is 1.5 times of the ideal sales volume of Tucki Weilai in the previous August, and the multiple is roughly the same.

The automobile market share is naturally reflected in the market value scale, and this logic is completely correct.

03

From years of losses to large-scale profits as soon as possible, Yan Kejun thought of Meituan (3690.HK). In 2022, Meituan also lost 6.7 billion yuan, and in a blink of an eye, its profit exceeded 8 billion in the first half of 2023.

Meituan and its founder Wang Xing are also ideal major shareholders. The ideal organization representing Wang Xing’s personal investment is "Zijin Global" and the organization representing the US Mission is "Inspired Elite".

The ideal US stock prospectus shows that Wang Xing has accumulated 133.3 million shares, with a total investment of 263 million US dollars and an average price of 1.97 US dollars per share. Meituan holds a total of about 282 million shares, with a cost of 820 million US dollars and a price of 2.92 US dollars per share.

The ideal IPO price of US stocks is $11.5 /ADS (every two ordinary shares are equal to one ADS), so the ideal market value of Wang Xing’s shareholding is $766 million, and the book yield is 191%. Meituan’s stock market value is 1.622 billion US dollars, and its book income is 97%.

After the ideal listing, the stock price once rose to nearly $48. In August, 2021, Ideal took advantage of the situation to list on the Hong Kong stock market for the second time, and the issue price was raised to HK$ 118 or US$ 15.17, which was more than 7.5 times the cost of Wang Xing’s shareholding. Due to the low shareholding ratio, it is very easy for venture capital shareholders including Wang Xing to choose the time to reduce their holdings.

On September 19, according to the disclosure of Hong Kong Stock Exchange, Wang Xing, CEO and ideal non-executive director of Meituan, reduced his holdings by about 1.96 million shares from September 12 to 15, with a price range of about HK$ 157.84-HK$ 160.51 per share, and cashed in about HK$ 311 million.

Compared with the cumulative number of shares held by Wang Xing, the reduction of 1.96 million shares is just Mao Mao Rain. By the end of June 2023, Zijin Global held 128 million shares, Inspired Elite, holding 376 million shares or 18.53% in total.

As the ideal official responded: "This stock trading is a personal act, and the transaction accounts for a small part of his total shareholding, and does not involve the shareholding of Meituan."

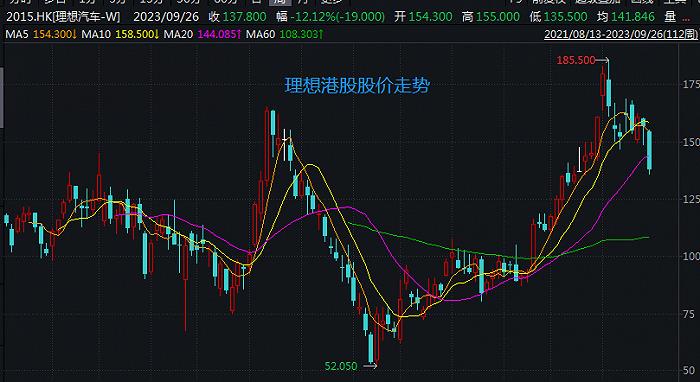

Having said that, the reduction of major shareholders has only symbolic significance to the stock price. After the ideal stock price entered a high point in early August, it was followed by a wave of obvious decline. In the last two trading days, the ideal Hong Kong stock fell by 7.7% on September 25th, and then fell by nearly 5% on September 26th. Its latest share price is about HK$ 138, which has retreated by about 26% compared with the high of US$ 185 and entered the "technical bear".

Need to add that, almost in the same period, Weilai Hong Kong stocks nearly halved, and Tucki also retreated by more than one third. The stock price trend of new power enterprises is very ugly.

The company’s revenue increased from more than 20% to 66%, 96% and 228% from the fourth quarter of 2022 to the second quarter of 2023. That is to say, from October 2022, the ideal has a quite sharp trend, rising from HK$ 52 to over HK$ 180, which has more than tripled.

The ideal sales volume has increased greatly, and the profit is expected to continue to increase. Should Wang Xing and other venture capitalists hold it? However, the stock price surge is based on a high growth base. Since the delivery base has been raised to a higher level in 2023, it will be extremely difficult to exceed three digits or more than 50% growth rate in 2024.

Should minority shareholders refer to "Xing Ge" and leave their bags in time?

关于作者